Tangerine Bank is the Canadian leading digital-only bank, recognized for revolutionizing online banking by eliminating the need for physical branches. As one of the first truly mobile-first banks in the country, Tangerine built its reputation on simplicity, transparency, and customer empowerment.

However, as digital competition intensified, Tangerine saw an opportunity to reimagine its mobile experience, transforming it from a transactional banking tool into a personalized financial companion. The goal was to modernize the app's usability, strengthen trust, and position Tangerine as a design leader in Canada's evolving fintech ecosystem.

As Senior Product Designer, I collaborated closely with product, research, and engineering teams to re-architect the end-to-end mobile experience, balancing innovation with accessibility, performance, and the emotional trust customers expect from a bank they rely on daily.

As new fintech startups entered the market with sleek, human-centered mobile experiences, Tangerin's once trailblazing digital presence began to lag behind. Legacy systems and static user interfaces made it difficult to compete with agile competitors like Wealthsimple, Koho, and Revolut, brands that were redefining user expectations through speed, personalization, and transparency.

Customer research revealed growing frustration: users struggled to complete basic banking tasks efficiently, couldn't visualize their financial health, and felt disconnected from the brand’s original promise of “banking made easy.” The result was measurable decline, 23% customer churn, 40% of support calls tied to app usability, and slow adoption of new product offerings.

Tangerine's leadership recognized the need for a full mobile transformation: a redesign that simplified core flows, elevated personalization, and reestablished trust in the brand's digital-first identity.

Business Challenges:

User Pain Points:

I owned the end-to-end experience design for Tangerine's mobile banking transformation, modernizing the mobile app experience to compete with fintech disruptors. Working alongside product managers, researchers, and engineering teams, I led the design workstream from discovery through delivery, creating a faster, simpler, data-informed mobile experience that reduced churn, support calls, and improved conversion rates across iOS and Android platforms.

Tangerine's leadership recognized that the mobile app experience was not competitive with fintech disruptors, threatening market position and customer retention. The mobile transformation initiative aimed to modernize the mobile banking experience and reverse declining metrics. Key business objectives included:

We benchmarked mobile banking experiences from leading fintech disruptors (Wealthsimple, Koho, Neo Financial) and digital banks (Simplii, EQ Bank) to inform a competitive, modern mobile banking UX. Key insights revealed that successful mobile banking apps prioritize speed, simplicity, and self-service, enabling users to complete banking tasks quickly without support intervention. We adapted these patterns to Tangerine's mobile banking ecosystem, creating a modernized experience that matched fintech standards while maintaining Tangerine's brand identity and regulatory compliance.

Interviews with 35 Tangerine customers and analysis of support ticket data revealed consistent patterns around mobile banking frustration:

These insights shaped our approach: creating a faster, simpler, data-informed mobile experience that enables self-service and competes with fintech disruptors.

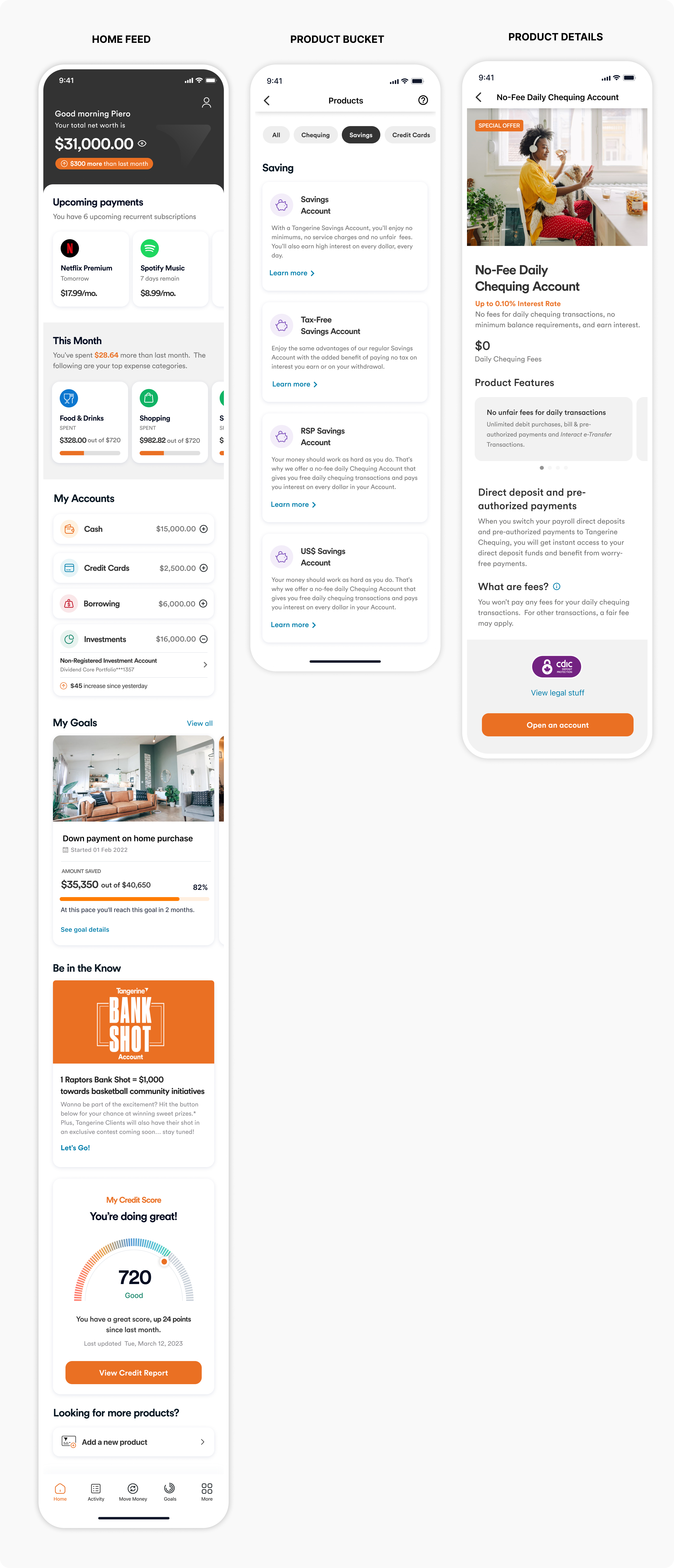

I redesigned Tangerine's mobile banking app to compete with fintech disruptors, creating a faster, simpler, data-informed mobile interface that reduces task time, enables self-service, and improves conversion rates. The new mobile experience simplifies navigation with touch-optimized interactions, reorganizes information architecture for mobile screens, and enables users to complete banking tasks without support intervention—transforming Tangerine from a lagging digital bank into a competitive player in the Canadian banking landscape.

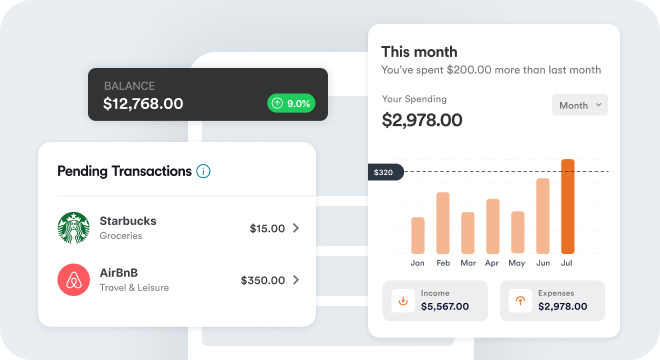

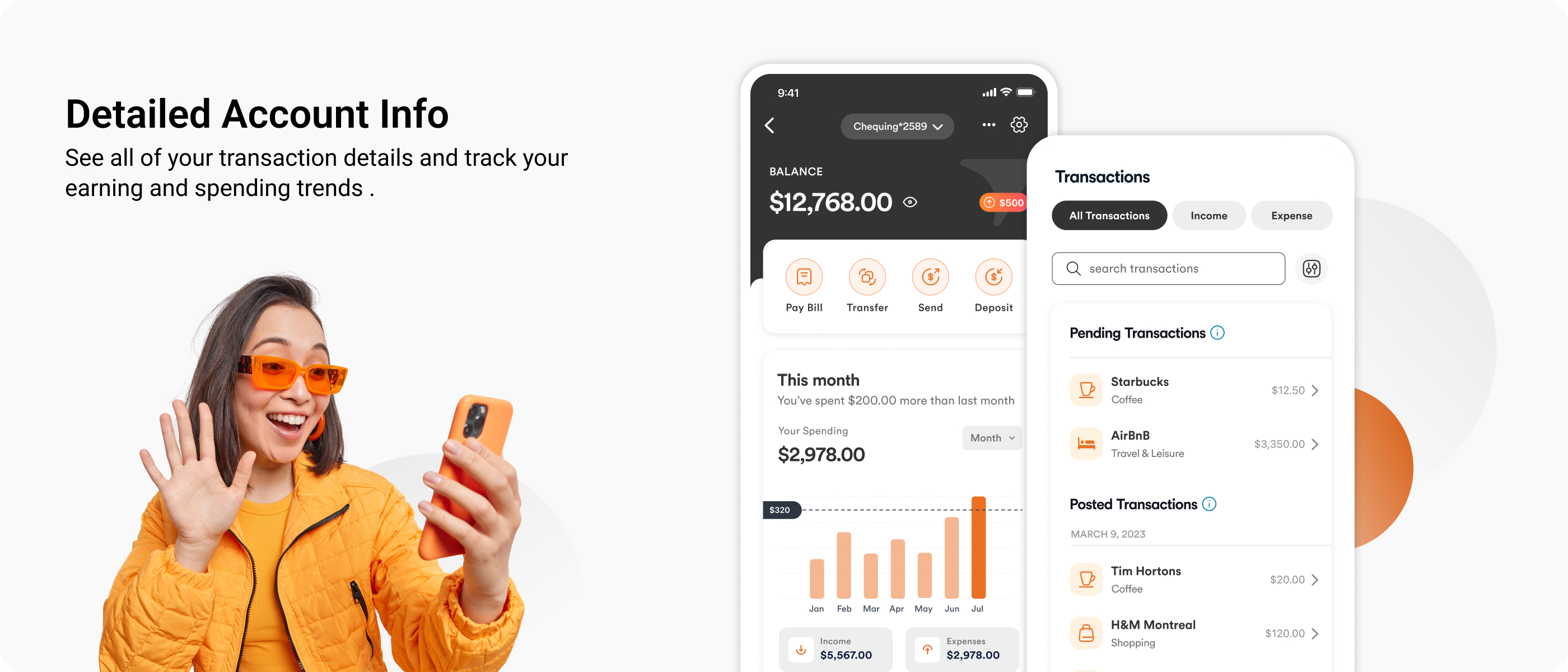

Give users a clear snapshot of their finances the moment they open the app. The redesigned dashboard surfaces key balances, recent transactions, and actionable insights at a glance eliminating the need to dig through menus or tabs.

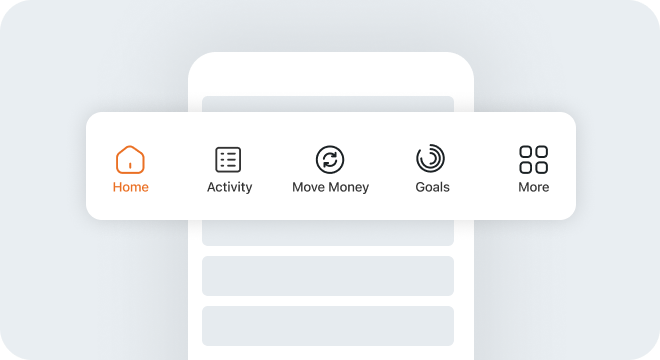

Show the new bottom or side navigation that reduces steps to core actions like Activity, Move Money and Goals. The new layout shortens task completion time and keeps users anchored, no matter where they are in the app

Enable new users to open accounts directly from the app with secure digital ID verification. The redesigned flow reduces friction by using native camera scanning, automatic ID validation, and instant identity confirmation, cutting onboarding time from days to minutes.

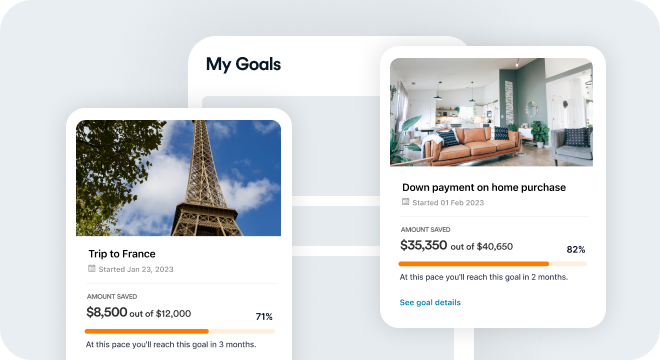

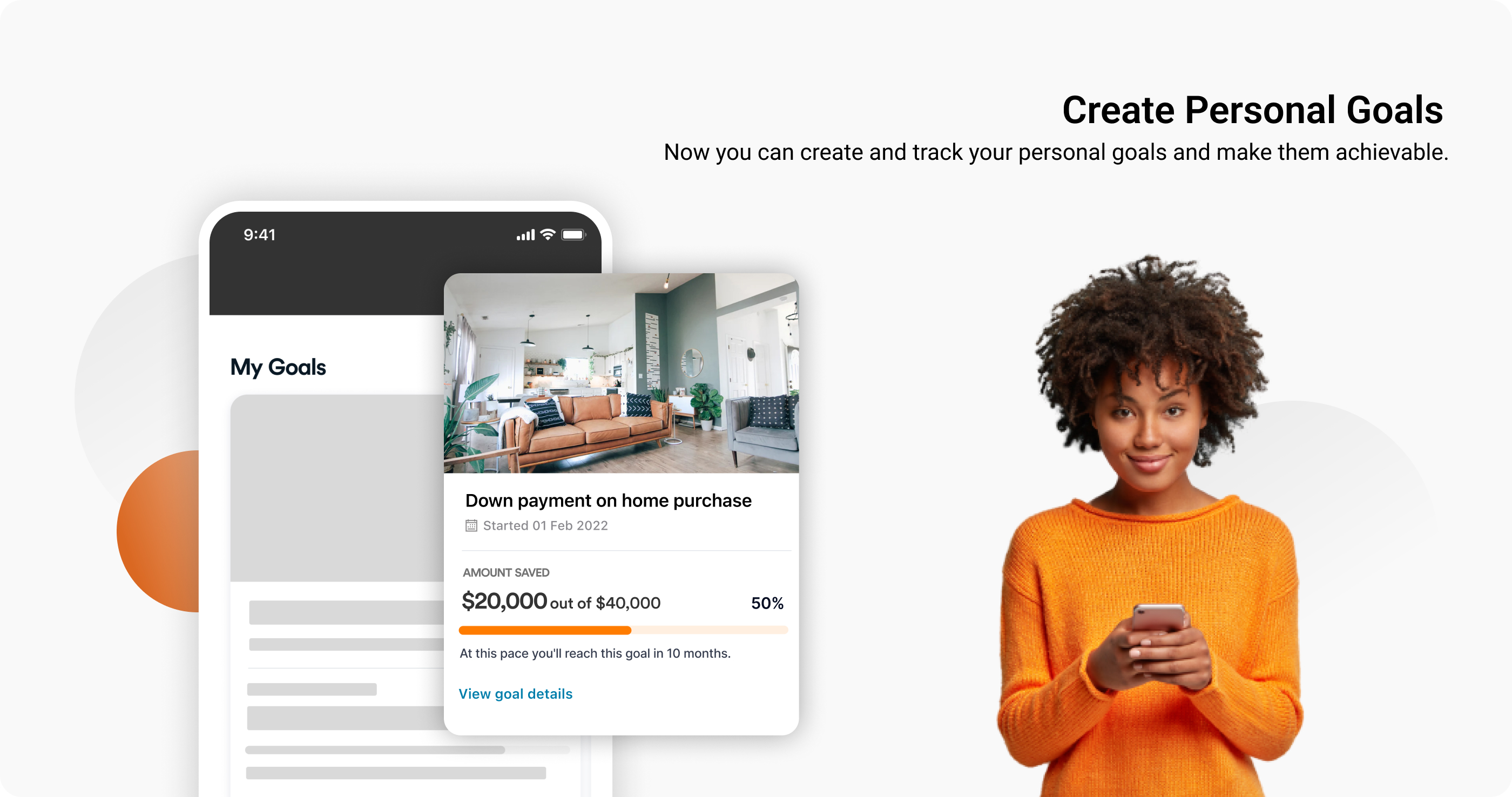

Empower users to create and fund savings goals effortlessly. The redesigned savings module allows users to set goals, automate contributions from each paycheck, and track progress visually with smart nudges that encourage consistent saving habits.

To extend the value of Tangerine's mobile transformation beyond surface-level design, we modernized the underlying mobile banking platform architecture—improving performance, responsiveness, and user experience across iOS and Android platforms. The platform modernization introduced faster load times, improved touch responsiveness, and enhanced reliability—enabling users to complete banking tasks quickly and reliably on mobile devices without delays or errors.

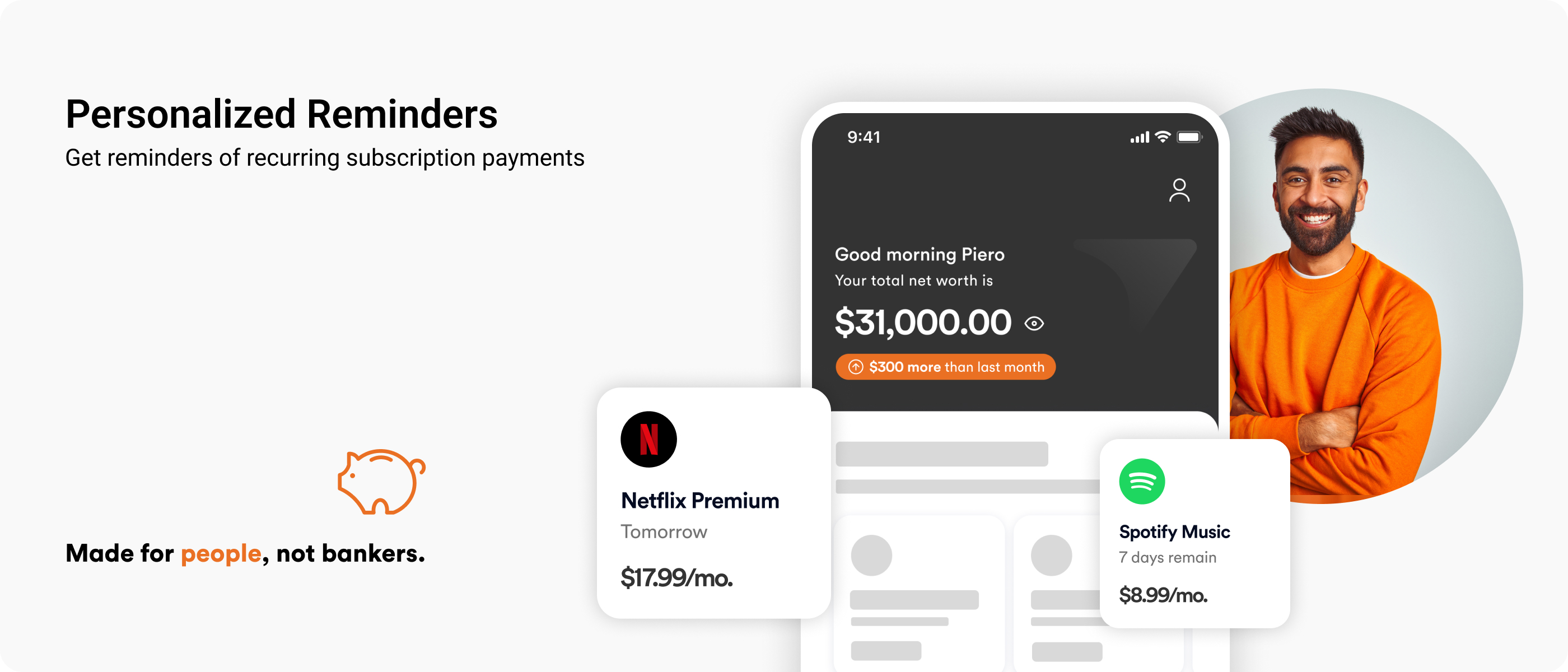

The mobile platform modernization introduced data-informed personalization, proactive help features, and intelligent self-service tools optimized for mobile—helping users discover products, complete tasks, and find answers without support intervention. By combining touch-optimized navigation, mobile-first information architecture, and modern mobile platform infrastructure, Tangerine's mobile transformation transformed from a design update into a comprehensive mobile banking modernization that positioned Tangerine as competitive with fintech disruptors in the Canadian banking landscape.

The Tangerine mobile transformation successfully modernized the mobile banking experience—successfully bridging legacy banking constraints with fintech-level usability and positioning Tangerine as competitive in the Canadian banking landscape.

Measured Outcomes:

The success of Tangerine's mobile transformation demonstrated that digital banks could compete with fintech disruptors — not through longer timelines, but through smarter, user-centered mobile design that simplifies navigation, enables self-service, and improves information architecture.

Through this initiative, we learned that competing with fintech disruptors on mobile goes beyond feature parity. It requires speed, simplicity, and self-service optimized for touch interactions and mobile screens. By aligning product, design, and engineering around a shared goal of faster, simpler mobile banking, we reduced task time, enabled self-service, and improved conversion rates. Touch-optimized navigation, mobile-first information architecture, and data-informed mobile design proved essential in turning a lagging digital bank into a competitive player in the Canadian banking landscape.

Complex mobile navigation slows users down and drives frustration. During research, we learned that users were taking 3x longer to complete banking tasks on mobile than necessary due to navigation complexity. By redesigning the mobile navigation structure to be clear, intuitive, and touch-optimized, we reduced task completion time significantly. The key was eliminating unnecessary taps, reducing cognitive load, and enabling users to find what they needed quickly on mobile devices—transforming mobile banking from a time-consuming process into a fast, efficient experience.

Poor data organization prevents users from finding products and completing tasks on mobile. We reorganized the information architecture specifically for mobile screens to improve findability, discoverability, and conversion—enabling users to discover new products, understand features, and complete applications without confusion on small screens. Better mobile information architecture improved conversion rates on new product offerings by 58%—proving that mobile-optimized organization and structure are as important as visual design in driving business outcomes.

When users can't complete tasks independently on mobile, they call support. We designed mobile self-service features that enabled users to manage accounts, troubleshoot issues, and find answers on their mobile devices without human intervention—reducing support call volume from 40% to 13%. This mobile self-service approach transformed banking from a reactive support model into a proactive, user-empowered mobile experience—significantly reducing operational costs while improving user satisfaction. The key was making help available when needed on mobile, not requiring it for basic tasks.

Thanks to crossfunctional partners across product, research, engineering and operations.

Mentored 2 junior designers on accessibility testing and user research, perfecting their visual design craft and shaping them into confident contributors to future Mobile UX projects.